Depending on your GSA contract, you will need to report GSA sales either monthly or quarterly.

Quarterly - most contracts are written under traditional requirements to report sales quarterly. This means within 30 days of the end of each calendar quarter.

Monthly - Only if you elected the Transactional Data Reporting option, would you need to report monthly (within 30 days of the end of each month)

For new vendors, Within three months of receiving a GSA contract, vendors need to report their sales. This is required within 30 days of the close of each calendar quarter, even when you may not have sold anything. Fortunately, the sales reporting process is rather straightforward for most firms.

GSA Sales Reporting Requirements

First, make sure you adjust your accounting system so that you can identify all sales by SIN, because you must report GSA sales by each SIN awarded under your contract.

Sales Reporting Portal

Sales Reporting Portal

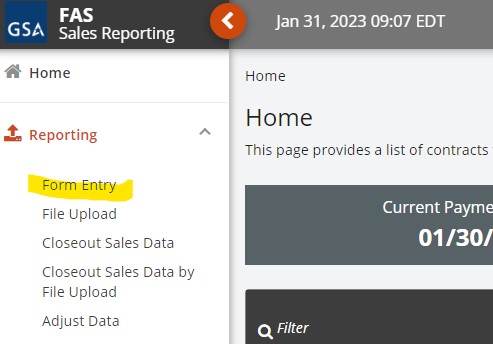

Next, go to https://srp.fas.gsa.gov. This is also accessible from GSA's Vendor Support Center.

Only the firm's Contract Administrator or Authorized Negotiators may report sales. You will need to use your FAS ID to log in. Each authorized person should have done obtained this ID when they applied for a GSA contract. This FAS ID can be obtained here.

Once you are in, you will come to a screen similar to the one below and you can fill in your firm’s sales by SIN. Be sure to report sales in whole dollars (no cents). If you had no sales, you must still report “0.”

Enter Sales by SIN number for traditional offers, or enter the transactions for the month if a TDR contract.

GSA Industrial Funding Fee

Currently, the IFF paid is equal to .75% of the sale of GSA-listed items sold during the quarter.

When do you recognize a GSA sale?

GSA requires you to decide when you will recognize your sale, using one of the four methods below. Once you determine this, you must stay with this method for the life of the contract.

- Date of sale (a receipt of order)

- Shipment or Delivery

- Issuance of Invoice

- Receipt of payment